单词很忙

分题型分考点背单词 文

文

6月28日,十四届全国人大常委会第十次会议表决通过关于修改会计法的决定,自2024年7月1日起施行。

本次修改大幅提高了财务造假法律责任追究力度。对于伪造、变造会计凭证、会计账簿,编制虚假财务会计报告等违法行为,以前罚款上限是10万元,现在是违法所得的10倍。对于授意、指使编制虚假财务会计报告等,以前罚款上限是5万元,现在是500万元。

“这次会计法修改有很多引人注意的地方,比如违法所得最多处罚10倍。这具有经济和变革背景的色彩,也是促进会计事业走向更真实的关键性一步,对上市公司主体和会计事务所履行职责上发挥了亡羊补牢的积极作用,期望能有效改善经济活动中财务造假问题。”上海立信会计金融学院教授温建宁向券商中国记者表示。

处罚力度大幅提升

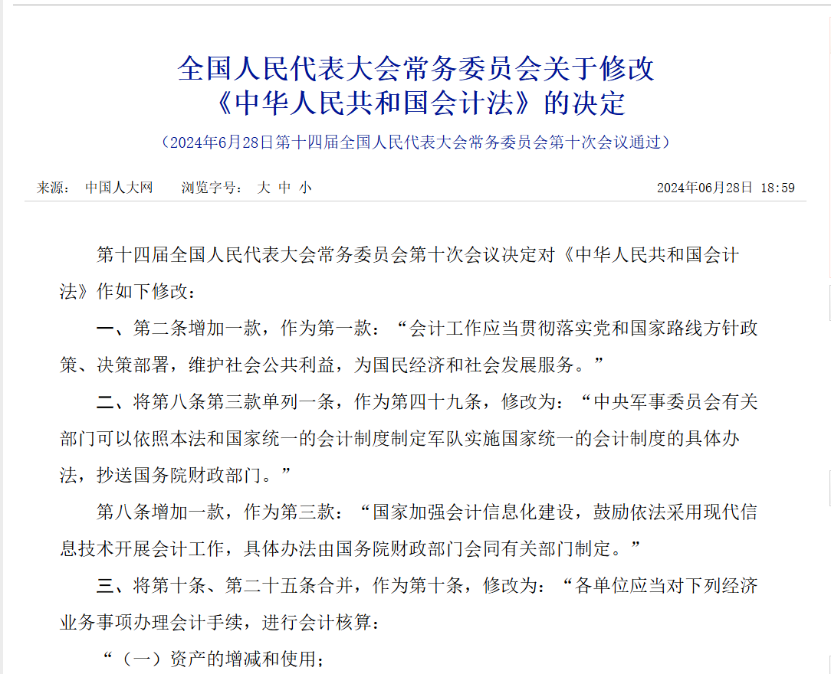

据悉,新修改的会计法将原会计法第四十三条、第四十四条合并,作为第四十一条,修改为:

“伪造、变造会计凭证、会计账簿,编制虚假财务会计报告,隐匿或者故意销毁依法应当保存的会计凭证、会计账簿、财务会计报告的,由县级以上人民政府财政部门责令限期改正,给予警告、通报批评,没收违法所得,违法所得二十万元以上的,对单位可以并处违法所得一倍以上十倍以下的罚款,没有违法所得或者违法所得不足二十万元的,可以并处二十万元以上二百万元以下的罚款。”

“对其直接负责的主管人员和其他直接责任人员可以处十万元以上五十万元以下的罚款,情节严重的,可以处五十万元以上二百万元以下的罚款;属于公职人员的,还应当依法给予处分;其中的会计人员,五年内不得从事会计工作;构成犯罪的,依法追究刑事责任。”

在原会计法中,同样的违法行为,处理方式是:“由县级以上人民政府财政部门予以通报,可以对单位并处五千元以上十万元以下的罚款;对其直接负责的主管人员和其他直接责任人员,可以处三千元以上五万元以下的罚款。”

此外,新会计法还将原会计法第四十五条改为第四十二条,修改为:“授意、指使、强令会计机构、会计人员及其他人员伪造、变造会计凭证、会计账簿,编制虚假财务会计报告或者隐匿、故意销毁依法应当保存的会计凭证、会计账簿、财务会计报告的,由县级以上人民政府财政部门给予警告、通报批评,可以并处二十万元以上一百万元以下的罚款;情节严重的,可以并处一百万元以上五百万元以下的罚款;属于公职人员的,还应当依法给予处分;构成犯罪的,依法追究刑事责任。”

原会计法对此的处罚是:可以处五千元以上五万元以下的罚款;属于国家工作人员的,还应当由其所在单位或者有关单位依法给予降级、撤职、开除的行政处分。

上海久诚律师事务所律师许峰向券商中国记者表示:“新会计法对财务造假等违法行为大幅度加大了处罚力度,意味着未来财务造假的成本将随着违法所得金额的升高而大幅度增长,能够有效遏制财务造假行为。”

遏制财务造假

温建宁向记者表示,经济发展的大背景变了,会计法的修改顺理成章,既适应了新时代对会计制度的发展要求,也体现了经济活动对会计准则变革的时代要求。以银行金融供给为主的间接融资,虽然最大限度地开发了土地要素的资源价值,形成了与之相应的会计准则和奖惩措施,但建设中国式现代化的新发展时期,更需要以金融市场为主的直接融资,以便搭建更为有效的“科技立国+金融强国”的新模式,以便形成依靠“举国体制+人民智慧”的动力源,以便建立“市场主体+违法惩戒”的新轨道,很自然地就需要新会计制度服务于新发展要求,形成宽严结合强化违法惩处的新理念。

据悉,早在今年的4月23日,在十四届全国人大常委会第九次会议上,受国务院委托,财政部副部长廖岷就作了关于《中华人民共和国会计法(修正草案)》的说明。

随着经济社会不断发展,会计工作面临着新形势新任务,出现了一些新情况新问题,如会计监管缺乏有效手段和措施,会计违法案件查处困难、处罚力度偏轻;会计信息失真、缺少内部控制,特别是上市公司财务造假、内部财务审计缺失等会计违法行为时有发生。

此次修改会计法,保持现行基本制度不变,着力解决会计工作中的突出问题,完善会计制度,加强会计监督,加大法律责任追究力度,为遏制财务造假等会计违法行为提供更加有力的法治保障。

会计法修正草案加大财务造假法律责任追究力度。与《证券法》等有关法律的处罚规定相衔接,修正草案规定:一是提高不依法设置会计账簿、私设会计账簿等违法行为的罚款额度。二是提高伪造、变造会计凭证、会计账簿,编制虚假财务会计报告等违法行为的罚款额度。三是提高授意、指使、强令会计机构、会计人员及其他人员伪造、变造会计凭证、会计账簿,编制虚假财务会计报告等违法行为的罚款额度。同时,对直接负责的主管人员和其他直接责任人员的罚款额度作了相应调整。

Accounting law Amendment! Heavy punishment for financial fraud, with a maximum penalty of 10 times

On June 28, the 10th meeting of the Standing Committee of the 14th National People's Congress voted to pass the decision on amending the Accounting Law, which will come into effect on July 1, 2024.

This revision significantly increases the legal accountability for financial fraud. For illegal activities such as forging or altering accounting vouchers, accounting books, and preparing false financial accounting reports, the previous fine limit was 100000 yuan, but now it is 10 times the illegal income. For instructions and instructions to prepare false financial accounting reports, the previous fine limit was 50000 yuan, but now it is 5 million yuan.

"There are many noteworthy aspects to this revision of the Accounting Law, such as a maximum penalty of 10 times for illegal gains. This has a color of economic and transformative background, and is also a crucial step in promoting a more authentic accounting career. It plays a positive role in filling the gap in fulfilling the responsibilities of listed companies and accounting firms, hoping to effectively improve the problem of financial fraud in economic activities." Wen Jianning, a professor at Shanghai Lixin Institute of Accounting and Finance, told a reporter from Securities China.

Significant increase in punishment intensity

It is reported that the newly revised accounting law will merge Article 43 and Article 44 of the original accounting law as Article 41, and amend it to:

"Those who forge or alter accounting vouchers, accounting books, prepare false financial accounting reports, conceal or intentionally destroy accounting vouchers, accounting books, and financial accounting reports that should be kept in accordance with the law shall be ordered by the financial department of the people's government at or above the county level to make corrections within a time limit, given a warning or criticism, and their illegal gains shall be confiscated. If the illegal gains exceed 200000 yuan, the unit may be fined not less than twice but not more than ten times the illegal gains. If there are no illegal gains or the illegal gains are less than 200000 yuan, a fine of not less than 200000 yuan but not more than 2 million yuan may be imposed."

"The directly responsible supervisors and other directly responsible personnel may be fined not less than 100000 yuan but not more than 500000 yuan. If the circumstances are serious, a fine of not less than 500000 yuan but not more than 2 million yuan may be imposed. If they are public officials, they shall also be punished in accordance with the law. Accounting personnel shall not engage in accounting work for five years. If a crime is constituted, criminal responsibility shall be pursued in accordance with the law."

In the original Accounting Law, the same illegal behavior was dealt with as follows: "The financial department of the people's government at or above the county level shall issue a notice and may impose a fine of not less than 5000 yuan but not more than 100000 yuan on the unit; the directly responsible person in charge and other directly responsible personnel may be fined not less than 3000 yuan but not more than 50000 yuan."

In addition, the new Accounting Law also changes Article 45 of the original Accounting Law to Article 42, which reads: "Those who instruct, instruct, or force accounting institutions, accounting personnel, and other personnel to forge or alter accounting vouchers and accounting books, prepare false financial accounting reports, or conceal or intentionally destroy accounting vouchers, accounting books, and financial accounting reports that should be preserved according to law shall be warned, criticized, and may be fined not less than 200000 yuan but not more than 1 million yuan by the financial department of the people's government at or above the county level. If the circumstances are serious, a fine of not less than 1 million yuan but not more than 5 million yuan may be imposed. Those who belong to public officials shall also be punished in accordance with the law. If a crime is constituted, criminal responsibility shall be pursued in accordance with the law."

The original accounting law's punishment for this was: a fine of not less than 5000 yuan but not more than 50000 yuan can be imposed; Those who belong to state employees shall also be given administrative sanctions such as demotion, dismissal, or dismissal by their unit or relevant units in accordance with the law.

Xu Feng, a lawyer at Shanghai Jiucheng Law Firm, told a reporter from a securities firm in China, "The new accounting law has significantly increased the punishment for illegal activities such as financial fraud. This means that the cost of financial fraud will increase significantly in the future with the increase of illegal gains, which can effectively curb financial fraud."

To curb financial fraud

Wen Jianning told reporters that the overall background of economic development has changed, and the revision of the accounting law is natural. It not only meets the development requirements of the new era for the accounting system, but also reflects the era's requirements for the reform of accounting standards in economic activities. Although the indirect financing mainly based on bank financial supply has maximized the resource value of land elements and formed corresponding accounting standards and reward and punishment measures, in the new development period of building Chinese path to modernization, direct financing mainly based on financial markets is more needed to build a more effective new model of "building the country through science and technology+financial power", so as to form a power source relying on "national system+people's wisdom", so as to establish a new track of "market subject+punishment for violations", which naturally requires the new accounting system to serve the new development requirements and form a new concept of combining leniency with severity and strengthening punishment for violations.

It is reported that as early as April 23rd this year, at the 9th meeting of the 14th National People's Congress Standing Committee, entrusted by the State Council, Vice Minister of Finance Liao Min gave an explanation on the "Accounting Law of the People's Republic of China (Revised Draft)".

With the continuous development of the economy and society, accounting work is facing new situations and tasks, and some new situations and problems have emerged, such as the lack of effective means and measures for accounting supervision, difficulties in investigating and punishing accounting violations, and relatively light punishment; Accounting information distortion, lack of internal control, especially accounting violations such as financial fraud and lack of internal financial auditing by listed companies, often occur.

This revision of the Accounting Law will maintain the current basic system, focus on solving prominent problems in accounting work, improve accounting systems, strengthen accounting supervision, increase legal accountability, and provide more powerful legal protection to curb accounting violations such as financial fraud.

The draft amendment to the Accounting Law increases the legal accountability for financial fraud. In line with the punishment provisions of relevant laws such as the Securities Law, the revised draft stipulates: firstly, to increase the fine amount for illegal acts such as not setting accounting books in accordance with the law or setting accounting books privately. The second is to increase the amount of fines for illegal activities such as forging or altering accounting vouchers, accounting books, and preparing false financial accounting reports. The third is to increase the fine amount for illegal activities such as instructing, instructing, and forcing accounting institutions, accounting personnel, and other personnel to forge or alter accounting vouchers, accounting books, and prepare false financial accounting reports. At the same time, corresponding adjustments have been made to the fine amount for directly responsible supervisors and other directly responsible personnel.

句子成分分析:(划分说明![]() ) 提示:框中标识可点击

) 提示:框中标识可点击

(提示: 读句时出现中断。(原因))

Accounting information distortion,

lack (of internal control),

especially accounting violations (such as financial fraud and lack (of internalfinancial auditing))

by

listed

companies,

often occur.

句子语法结构详解:

* 第1个 Accounting 为动名词。

* especially accounting 为动名词。

* auditing 为动名词,作介词宾语。

* listed 为过去分词。

* often 开头为祈使句。

* occur 为谓语。

句子相关词汇解释:

Phrase:

| such as | 1) 例如,比如 2) 像……那样的,诸如……之类的 |

Vocabulary:

| account [ә'kaunt] | vt. | 认为是,视为 |

| vt. | 认为是,视为 | |

| information [,infә'meiʃәn] | n. | 1) 信息,消息,情报,资料,资讯 2) 书的信息内容 |

| distortion [dis'tɔ:ʃәn] | n. | 歪曲,扭曲,变形 |

| lack [læk] | n. | 缺少,缺乏,短缺 |

| internal [in'tә:nәl] | a. | 1) 内部的,里面的 2) 体内的 |

| control [kәn'trәul] | n. | 1) 控制(能力),操纵(能力) 2) 限制,约束,管制 3) 操纵装置,开关,按钮 4) 管理权,支配权 |

| especially [i'speʃәli] | ad. | 1) 尤其;特别;格外 2) 专门;特地 |

| violation [,vaiә'leiʃәn] | n. | 违反, 违背, 妨碍 |

| financial [fai'nænʃәl] | a. | 财政的,财务的,金融的 |

| fraud [frɔ:d] | n. | 1) 欺诈罪,欺骗罪 2) 行骗的人,骗子 |

| and [ænd] | conj. | 1) 和, 与, 同, 并 2) 然后,接着 |

| list [list] | vt. | 1) 列举,把……列入一览表 2) 把……列表,列清单,造表 |

| company ['kʌmpәni] | n. | 1) 公司 2) 陪伴 |

| often ['ɔ:fn] | ad. | 常常; 经常; 时常 |

| occur [ә'kә:] | vi. | 1) 发生,出现 2) 存在于,出现在 |

句子成分分析:(划分说明![]() ) 提示:框中标识可点击

) 提示:框中标识可点击

[In line (with the punishment provisions (of relevant laws (such as the SecuritiesLaw)))], the revised draft stipulates: [firstly], [to increase the fine] amount (forillegal acts (such as not setting accounting)) books [in accordance] [with the lawor setting accounting books [privately]].

句子语法结构详解:

* revised 为过去分词作定语

* stipulates 为谓语,采用一般现在时。动词采用第三人称单数形式。

* to increase 为不定式。不定式短语作句子状语。

* not setting 为动名词否定形式,作介词宾语。

* 第1个 books 为谓语,采用一般现在时。动词采用第三人称单数形式。

* 第2个 setting 为动名词。

* the 为定冠词。

句子相关词汇解释:

Phrase:

| in line with... | 与...符合, 与...一致, 与...接轨, 按照 |

| such as | 1) 例如,比如 2) 像……那样的,诸如……之类的 |

| in accordance with... | 按照..., 依据... |

Vocabulary:

| punishment ['pʌniʃmәnt] | n. | 1) 惩罚,处罚,刑罚 2) 粗暴对待,虐待 |

| provision [prә'viʒәn] | n. | 1) 提供,供给,给养,供应品 2) (为将来做的)准备 |

| relevant ['relivәnt] | a. | 1) 有价值的,有意义的 2) 紧密相关的,切题的 |

| law [lɔ:] | n. | 1) 法律,法规 2) 原理,定律 |

| security [si'kjuriti] | n. | 1) 安全,平安 2) 保护措施, 保卫部门, 安全工作 3) (securities)证券 |

| revise [ri'vaiz] | vt. | 1) 修改,修订(书刊、估算等) 2) 改变,修改(意见或计划) |

| draft [drɑ:ft] | n. | 1) 草稿,草图 2) [财]汇票 |

| firstly ['fә:stli] | ad. | (用于列举)第一,首先 |

| increase [in'kri:s] | vt. | 使增长,增多,增加 |

| fine [fain] | n. | 罚款,罚金 |

| amount [ә'maunt] | n. | 1) 数量,数额(尤与不可数名词连用) 2) 金额 |

| illegal [i'li:gәl] | a. | 不合法的,非法的,违法的 |

| act [ækt] | n. | 1) 行为,行动 2) 法案,法令 |

| not [nɔt] | ad. | 1) 不,没有 2) 不没有 |

| set [set] | vt. | 1) 放,置,使处于 2) 布置,分配,指派 3) 树立,创立,开创 4) 设置,调整好,安排就绪 |

| accounting [ә'kauntiŋ] | n. | 1) 会计, 会计学, 会计制度 2) 账单,账目 |

| book [buk] | vi. | (向旅馆、饭店、戏院等)预约,预订 |

| n. | 1) 书,书籍 2) 出版物,著作 | |

| or [ɔ:] | conj. | 1) 或,或者,还是 2) 否则,要不然 |

| set [set] | vt. | 1) 放,置,使处于 2) 布置,分配,指派 3) 树立,创立,开创 4) 设置,调整好,安排就绪 |

以上是蜂贝为您整理编写的文章《会计法修改!重罚财务造假,最高罚10倍》的全部内容。蜂贝是国内权威分题型分考点背诵中高考/四六级考研/专升本/出国单词的专业单词软件。扫描如下小程序码,进入蜂贝官方小程序获取更多英语相关资料! 【关键词:高考单词;高考英语;高中单词;高中英语;单词app;单词软件;记单词app;记单词软件;背单词软件;背单词app;英语单词;四六级单词;四六级英语;四六级单词app;四六级单词软件;考研单词app;考研单词软件;核心单词;高考冲刺复习;高考英语教材;高考英语真题;四六级真题;四六级试题;考研真题;考研英语单词;考研英语真题】